Investment for Diwali 2025: Real Estate vs Gold vs Stocks

In This Article

Diwali is more than a holiday of lights; it's a time of new beginnings and thoughtful investments. Each year, individuals throughout India wonder about the same question: Do I invest in gold, stocks, or real estate this Diwali?

But in 2025, that choice is weighted differently.

With property prices stabilizing, the stock market remaining bullish but volatile, and gold reaching record levels, investors are reconsidering where their money will really grow rather than sit securely.

Gold continues to attract due to its liquidity and tradition. Stocks allure risk-takers in pursuit of fast returns. But real estate, especially along growth routes such as Karjat close to Mumbai and Pune, is becoming the investment that combines all three: stability, appreciation, and real value.

For those considering what is the best Diwali investment in 2025, this guide dissected how gold, shares, and property perform under important aspects such as risk, returns, and long-term potential, and how Karjat real estate is making both first-time homebuyers and experienced investors take notice this festive season.

Why Diwali Is Considered the Best Time for Smart Investments in 2025

Diwali has always represented new beginnings, prosperity, and wealth generation. Historically, families acquire gold, invest in real estate, and make important money decisions during this time of the year, believing it precedes wealth for the upcoming year. Right from buying gold on Dhanteras to booking new homes, Diwali remains India's most auspicious moment to invest in long-term assets.

It is not only a cultural belief, but a financial one too. Real estate developers, banks, and even the stock markets coordinate festive deals, easy payment schemes, and portfolio options with this sprit of prosperity. Diwali becomes more than a festival to many; it's the ideal time to accumulate money through gold, equities, or real estate investments.

But in 2025, investor habits are changing. While gold and stocks are still favored investments, there is increasingly a move towards tangible, lifestyle investments that merge returns with emotional satisfaction. Acquiring real estate in Karjat, for example, is becoming a preference for both financial appreciation as well as a tranquil lifestyle within easy reach of Mumbai and Pune. For those looking to buy property , you can explore our detailed guide on buying land in Karjat.

Still, among the numerous choices this Diwali, there is one question that stands out for most:

Do you invest in gold, stocks, or property during this holiday season?

In the following paragraphs, let's examine how each of these options accomplishes their risks, benefits, and why real estate, particularly that in Karjat, is a preferred choice for Diwali investment for 2025.

Buying Gold in Diwali: A Smart Investment in 2025?

For the average Indian family, Diwali is not complete without gold. Whether in jewelry, coins, or digital form, it has traditionally stood for prosperity, purity, and safeguarding of good fortune. Purchase of gold on Dhanteras is believed to bring in prosperity, so even now, millions of families celebrate the festival by incorporating gold into their savings.

From an investment point of view, gold continues to have obvious benefits:

-

High Liquidity: It can be readily bought or sold, in small or big amounts.

-

Safe Asset: Gold does not lose its value in times of uncertainty, serving as a financial safety net.

-

Festive Sentiment: Its emotional and cultural appeal makes it the first investment option during Diwali.

However, investors must also consider its shortcomings:

-

Limited Returns: Gold prices have increased steadily, about 15-18% over the past year, but in the long term, the growth curve is generally slower compared to other asset classes.

-

All-time high rate: Gold is at its all-time high rate, hence the further growth and high returns are doubtful

-

No Income Generation: Real estate or stocks generate rent or dividends, unlike gold.

-

Price Sensitivity: Short-term price action can be volatile, and in 2025, gold is already at historic highs, with less potential for sharp upside.

So, gold shines brightest as a symbol of tradition and stability. It's perfect for safeguarding wealth and respecting festive beliefs, but for those seeking better returns, value for lifestyle, or portfolio appreciation, gold alone might not do the trick this Diwali.

Is Investing in Stocks During Diwali 2025 a Good Idea?

Diwali has always had a special affinity with the stock market due to the ancient practice of Muhurat Trading. In this ritualistic one-hour session, traders feel that purchasing shares brings good fortune to the ensuing year. What began as a ritual has now evolved into a moment of optimism for both seasoned and first-time investors.

In recent years, more Indians have turned to equities as a way to grow their wealth faster than traditional assets like gold. And in 2025, with the markets exhibiting constant bullish trends and the Indian economy growing, stocks are still luring investors who are ready to take calculated risks.

Here's why stocks are a top choice:

- High Growth Prospects: Indian equities over the long term have offered some of the highest returns compared to all asset classes, thanks to sectors such as technology, energy, and infrastructure.

- Flexibility: It is possible to begin small, diversify between industries, and create incrementally, ideal for young or first-time investors.

- Liquidity: Stocks are simple to buy and sell, providing immediate access to money when required.

However, stocks have a learning curve and a couple of catches:

- Market Volatility: Prices can fluctuate sharply with global trends or investor sentiment.

- Knowledge-Intensive: Successful investing is based on research, patience, and timing.

- Emotional Pressure: Fear and greed tend to lead to impulsive trades, a frequent pitfall for new investors.

In 2025, India's stock market is poised for long-term growth, but it still pays off to those who adapt to discipline rather than impulse. For future-oriented investors celebrating Diwali, stocks can be a high-growth, high-risk component of a diversified portfolio.

Next, let's examine the one investment that combines emotional security with actual growth: real estate.

Is Real Estate the Best Diwali Investment in 2025?

After comparing gold for safety and stocks for growth, there’s one asset that blends both real estate. It’s tangible, stable, and deeply tied to the idea of long-term prosperity, which makes it a natural fit for Diwali investing.

Why Property Investment Shines During Diwali

In India, buying property during Diwali is more than a transaction it’s a symbol of new beginnings, security, and generational wealth. From urban apartments to scenic plots near Mumbai and Pune, families view it as a blessing that will appreciate in both emotional and financial value over time.

Unlike gold or stocks, real estate is something you can see, use, and pass down. It combines appreciation potential with functionality whether it’s living in your own home, earning rental income, or building a second home for family retreats.

Top Advantages of Investing in Real Estate This Festive Season

- Steady Growth and Appreciation: Property values in growth zones like Karjat have shown consistent upward trends due to infrastructure and tourism.

- Dual Benefit: In addition to long-term appreciation, real estate offers rental or homestay income, giving it an edge over gold or stocks.

Emotional Security: Owning land or a home brings unmatched peace of mind. It’s both an asset and a lifestyle investment.

Who Is Investing in Real Estate in 2025?

- Urban Professionals: Buyers from Mumbai and Pune are choosing Karjat plots and villas as weekend homes or long-term investments, drawn by affordability and proximity.

- First-Time Buyers: With lower entry prices compared to metro real estate, buying property in Karjat is a practical first step toward asset ownership.

- NRIs and Overseas Indians: Many NRIS and those who live overseas, are investing in Karjat real estate to build family homes or earn rental income, seeing it as both an emotional and financial connection to India.

Some considerations to keep in mind as you plan to invest in real estate,

- Increased Capital Requirement: In contrast to gold or shares, property investment requires higher initial capital.

- Reduced Liquidity: Disposing of property typically takes longer than selling gold or shares.

As we enter the festive season, one thing is clear: real estate is a favored Diwali choice, it’s a foundation for your future. And for buyers looking for strong growth with lifestyle appeal, emerging destinations like Karjat are redefining what festive investing truly means. In emerging hubs around Mumbai and Pune, people look for affordable plots, second homes, and weekend getaways that combine natural beauty with strong growth prospects.

Why Real Estate Around Karjat Stands Out

While real estate in general offers stability and long-term growth, not all locations deliver the same potential. For investors and families around Mumbai and Pune, emerging hubs like Karjat have been attracting attention for a reason.

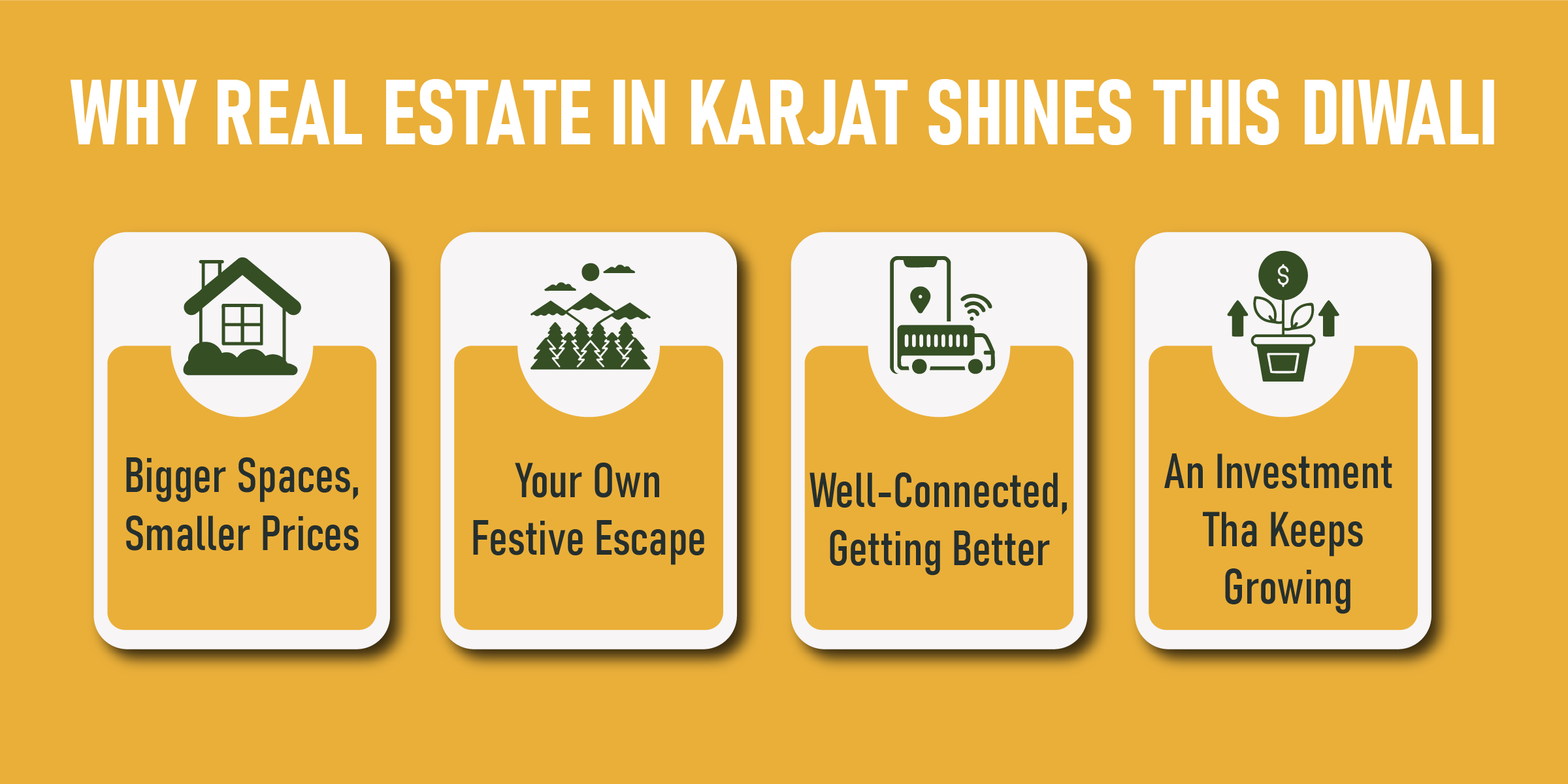

Here’s why Karjat stands out:

- Bigger Spaces, Smaller Prices

Karjat allows you to buy more land and larger houses at a fraction of what they cost in Mumbai or Pune. Families and investors can enter the market without stretching finances too far. This renders it one of the cheapest but high-potential real estate options in the vicinity of the metros. - Your Own Festive Escape

Celebrate Diwali or any weekend in a home amidst green hills, rivers, and scenic beauty. Karjat provides a peaceful way of life that city life can never offer. It's the ideal destination to relax, recharge, and make memories with family and friends. - Well-Connected, Getting Better

Only two hours from Mumbai, Karjat is becoming easy to reach. Upgrades on the highways, the upcoming quadruple railway line, and the new Navi Mumbai airport being developed are increasing connectivity. All these developments are making living in Karjat as well as investing in Karjat convenient and lucrative. - An Investment That Keeps Growing

With increasing numbers of people seeking residences beyond congested metros, Karjat property demand is steadily on the rise. Demand is incrementally driving property prices higher. Investors can witness steady growth with each passing year. - One Land, Many Dreams

Karjat offers unmatched flexibility in how you use your property. Build a villa, start a farmhouse, rent it to holiday travelers, or simply land-bank for future appreciation. The choice is yours, making it an investment that aligns with both lifestyle and financial goals.

In short, Karjat combines the best of tradition, lifestyle, and financial sense, making it an attractive choice for this Diwali. For those looking to invest in real estate that balances emotional and financial value, Karjat offers opportunities that gold and stocks simply cannot match. You can explore a detailed guide on buying land in Karjat to understand what makes this region a smart and practical investment.

Gold, Stocks, or Real Estate: How They Compare This Diwali

With Diwali around the corner, many investors wonder which option truly balances tradition, growth, and long-term value. This table breaks down the key differences between gold, stocks, and real estate, helping you see which investment suits your goals best.

|

Factor |

Gold |

Stocks |

Real Estate |

|

Tradition & Festive Value |

Strong cultural/emotional significance during Diwali |

Moderate: some buy stocks during Muhurat trading |

Very high: property purchases seen as auspicious |

|

Returns Potential |

Moderate, steady over long term |

High, but volatile |

Moderate to high, depending on location and type |

|

Risk Level |

Low |

High (market volatility) |

Medium (market cycles, liquidity) |

|

Liquidity |

Very high- easy to sell anytime |

High- easy to exit with the right timing |

Low- takes time to sell |

|

Capital Requirement |

Flexible- small or large |

Flexible- any amount |

High- needs a larger upfront investment |

|

Income Generation |

None |

Dividends (small, irregular) |

Rental income, holiday home income |

|

Tangible Ownership |

Yes, but a small asset |

No (paper asset) |

Yes- land, plot, or home |

|

Local Relevance (Karjat/Mumbai region) |

Limited- only as a safety asset |

Limited- purely financial |

Strong- land/villa appreciation, weekend homes, tourism demand |

Choosing the Right Diwali Investment

Each investment option, gold, stocks, or real estate, has its own strengths and fits different priorities:

- Gold offers tradition, safety, and easy liquidity.

- Stocks bring growth potential and flexibility, but come with market volatility.

- Real Estate combines tangible ownership, long-term appreciation, and lifestyle value.

Those searching for properties in Karjat, Universal Properties Karjat is unique in its in-depth local knowledge and handpicked property choices. From authenticated plots and villas to tips on upcoming locations, our real estate consultants assist first-time buyers or experienced investors at every stage, from legal inspection to documentation. Through the integration of market information and attention to lifestyle and long-term appreciation, they ensure easy and dependable navigation of Karjat's properties.

If you’re considering a real estate investment this Diwali, explore the opportunities in Karjat with Universal Properties. Visit us to learn more about properties that combine lifestyle, growth, and long-term value.

FAQs (Frequently Asked Questions)

Diwali is considered an auspicious time for new beginnings. Buying property during this festival is seen as a sign of prosperity and good fortune. Developers also offer festive deals, and investors in regions like Karjat benefit from both cultural significance and practical advantages.

Yes. Karjat offers affordable plots, scenic weekend homes, and strong growth potential due to its connectivity with Mumbai and Pune. While gold and stocks are liquid, real estate in Karjat combines appreciation potential with lifestyle benefits that other investments can’t match.

Gold prices rise gradually, and stocks can fluctuate sharply, but Karjat real estate has shown steady appreciation in recent years. Infrastructure projects like better road and rail connectivity further enhance long-term value, making it a stable and rewarding investment.

Yes, Karjat offers plots and properties at a wide range of price points, often more affordable than urban real estate in Mumbai or Pune. This makes it accessible for first-time buyers who might otherwise only consider gold or mutual funds.

Stocks are subject to market volatility and require active monitoring, while gold generally preserves wealth but doesn’t generate cash flow. Real estate in areas like Karjat, when purchased carefully, offers both appreciation and the option of rental income, reducing long-term risk.